I don’t need to tell you that the virus is back in full force with the largest number of new cases reported today. With regards to real estate this year, COVID has caused a flight from the city to the suburbs and an uptick in people buying vacation homes. Why is that? People are spending most of their time at home now – working from home, children remote learning and people bringing their parents into the fold so they can take care of them during lockdown have all caused a strain on everyone’s household. People need more space for home offices and for their children to play. Many want a more scenic place in which to be hunkered down. Sales down the Cape are on hot, hot, hot right now. I also see people buying vacation homes in NH and Maine. I can help you with a home purchase down the Cape, but if you want to buy outside MA I can refer you to a good agent in that area. Just let me know if you need help.

Many employers have found that work-from-home has not impacted employee productivity and so, they are telling employees that they will not be back in the office for the foreseeable future. This has caused people to be more confident about moving farther from their employers.

You are probably hearing that sales are on fire right now, but as with everything in life, the reality is that it depends – on where you are and what type of property we are talking about. I’ll get into that in an article below.

The two big questions on everyone’s mind are – will we see a repeat of the 2008-2009 market with it’s plummeting prices and foreclosures and what will this mean for the value of my home? Read on below….

The 2008 market collapse and foreclosure crisis were in big part due to loans being granted with no regard for whether borrowers were able to repay. Many of those people cashed-out the equity on top of that. With many borrowers owing more than they could afford on their homes, mass foreclosures followed.

Today’s market, however, looks a lot different. Lending standards are much stricter now and people have a lot of equity in their homes. This means that instead of foreclosing and walking away, many homeowners are in a good position to protect their investment.

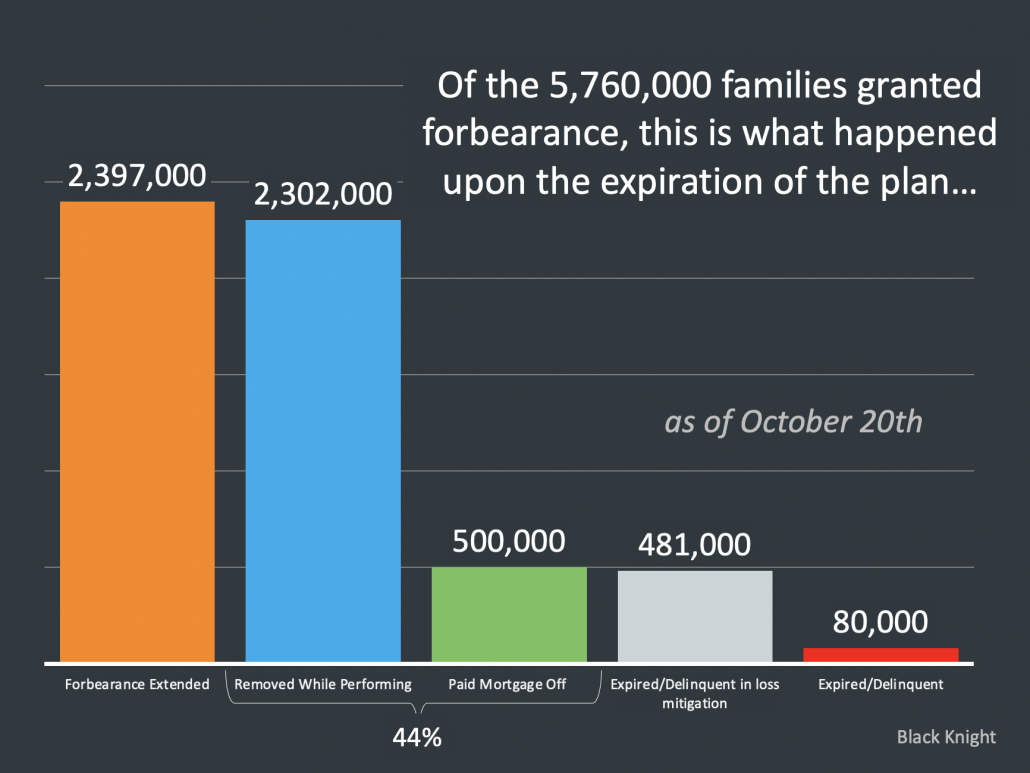

Looking at this graph, we can see that of those who requested forbearance, nearly 44% have either paid off their mortgage or opted out. It also shows that of all the homeowners in forbearance, only 80,000 are at risk of moving into foreclosures.

Attom Data reports 16.7 million homes are equity-rich as of Q3, meaning the amount of the loans secured by these homes is 50% or less than their market value.

That doesn’t mean there won’t be foreclosures. just that there will be far fewer than in 2009.