The bottom line for prospective homebuyers is this: The historically low mortgage rates of 2020 and 2021 are not coming back in 2022. But rates are likely to remain relatively low.

Even a jump to 4% by the end of the year in 2022 would be on par with, or better than, where rates were in the years prior to the coronavirus pandemic.

If the U.S. economy continues to recover from the pandemic volatility, and the shock of the delta variant, then it’s likely that rates will rise.

Therefore, if you have been on the fence about buying a house, now might be a good time to act. You may still be able to lock in a low rate before the end of the year.

National Association of Realtors’ (NAR) forecast

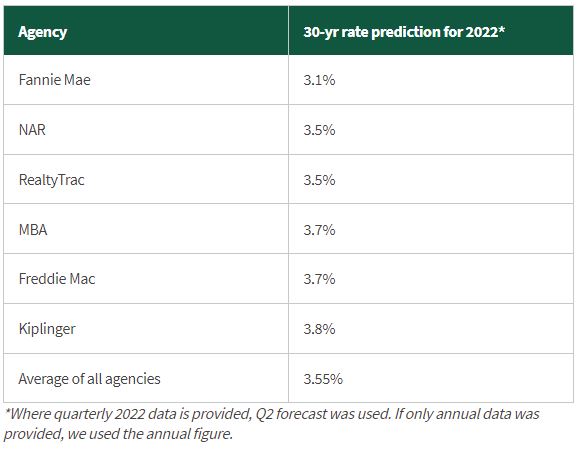

The leading organization for real estate professionals predicts the 30-year fixed-rate mortgage will climb slightly throughout 2022, reaching 3.5% in the second quarter and averaging 3.6% for the year, according to Nadia Evangelou, senior economist and director of forecasting for the NAR.

She pointed to several factors behind the association’s outlook.

“First, [the Federal Reserve] recently pushed up its inflation estimates for this year, indicating that inflation will be around longer. The grace period for higher inflation seems to be coming to an end, as the Fed will likely raise interest rates by the middle of next year,” Evangelou said. “When the Fed increases its interest rates, banks do, too. And when that happens, mortgage rates go up for borrowers.”

Additionally, the Fed recently announced that it will likely begin decreasing its purchases of long-term Treasuries and mortgage-backed securities starting this November. This strategy will also contribute to increased rates in 2022.

“Nevertheless, the global economy remains in a period of uncertainty due to the risk of the spread of coronavirus variants,” she said. “For instance, job growth was weak in August, reflecting the ongoing impact of the pandemic. Hence, by the first half of 2022, I don’t expect rates to rise more than 60 basis points from where they are now.”

Sixty basis points is the equivalent of 0.60%.

Rates could rise more slowly if poor job growth is observed next year. “But if the Fed’s tapering starts earlier, mortgage rates could rise even faster in the coming months,

RealtyTrac’s forecast

RealtyTrac, a real estate information company and online national marketplace for foreclosed and defaulted properties, expects the 30-year mortgage rate to reach 3.5% in the second quarter of next year before ending 2022 at 3.75%, per Rick Sharga, executive vice president for the company.

“Mortgage rates will probably increase for several reasons. These include higher yields on U.S. 10-year Treasuries, which commonly influence rates on 30-year fixed-rate loans, as well as maintained economic growth,”

Inflation is directly tied to the likelihood for higher rates. “Inflation is a big factor, and as the government appears ready to inject trillions more into the economy – in addition to the $7 trillion in stimulus spent during the pandemic – it would be a surprise if inflation didn’t run a little higher than what policymakers would like to see.”

“Inflation is a big factor, and as the government appears ready to inject trillions more into the economy, it would be a surprise if inflation didn’t run a little higher than what policymakers would like to see.”

On the other hand, if global economies struggle, a surge of U.S. Treasuries purchases could occur, signaling a flight to safety.

“That could push down bond yields and take mortgage rates down with them.”

Fannie Mae’s forecast

Fannie Mae’s most recent housing forecast is more optimistic, anticipating that mortgage rates will average nearly 3.1% throughout 2022, possibly hitting as high as 3.2% in the fourth quarter of next year.

“If the pace of income growth doesn’t keep up with inflation and interest rates rise more than expected, we’d expect housing activity to slow from our current projections.”

-Doug Duncan, Fannie Mae senior vice president and chief economist

“Economic growth continues to be held back by supply chain and labor market constraints, both of which we expect to continue well into 2022,” said Doug Duncan, Fannie Mae senior vice president and chief economist, in a recent news release. “We also expect inflation to remain elevated through much of next year, even if the crest of the recent surge is behind us.”

Duncan added that, “given the strength of recent house price appreciation and rent growth, we continue to believe that the contribution from housing to underlying inflation has yet to be fully realized within the official measures of inflation. Further, affordability remains a challenge, even with mortgage rates near historic lows. If the pace of income growth doesn’t keep up with inflation and interest rates rise more than expected, we’d expect housing activity to slow from our current projections.”

Freddie Mac’s forecast

In its most recent Economic and Housing Market Outlook, Freddie Mac envisions the 30-year fixed-rate mortgage averaging 3.7% in 2022, rising as high as 3.8% in the fourth quarter of that year.

Sam Khater, Freddie Mac’s chief economist stated in a recent news release: “As the economy continues to mend, the housing market remains strong even as certain obstacles have begun to slow sales across the country…Despite the housing market’s recent highs, there are indications of softening demand in recent home purchase mortgage applications data. We expect refinance activity to soften as higher mortgage rates dampen activity.”

In short, the record-high demand that sent home prices soaring during the past year will likely slow, in part due to rates climbing (albeit relatively slowly) in 2022.

Freddie Mac’s most recent quarterly forecast stated that it expects “house price growth to moderate in 2022, with full-year house price growth of 12.1% in 2021 followed by 5.3% in 2022.”

That’s good news for would-be homeowners who plan to wait a few more months before getting into the market. A slowdown in housing prices could mean more affordable options. Couple with higher interest rates, the market could normalize somewhat and give more homebuyers a chance.

Mortgage Bankers Association’s (MBA) forecast

The highly respected MBA, in its most recent Mortgage Finance Forecast, posted a bold prediction: Mortgage rates will average 4.2% next year, although rates in the first quarter may average 3.5%.

In their September 2021 forecast commentary, Mike Fratantoni and Joel Kan with the MBA state the following: “The (Fed’s) pending taper and change to the monetary policy outlook will likely contribute to a modest increase in mortgage rates over the medium term.”

“The biggest challenge to the housing market continues to be the lack of supply, hindered by the same supply chain constraints that are impacting the broader economy.” “MBA is forecasting growth in home sales and purchase mortgage originations for next year and beyond, but does expect a sharp decline in refinance volumes.”

The MBA predicts that home purchases will continue to rise, nonetheless, but it anticipates a drop in refinance loans. Many homeowners rushed to refinance when rates hit historic lows in 2020 and stayed low in 2021. But as rates rise in 2022, fewer homeowners will see an advantage to refinancing.

Kiplinger’s forecast

Many turn to Kiplinger for financial advice, including guidance on where mortgage rates will land. Kiplinger foresees the 30-year fixed-rate mortgage averaging just shy of 4% once 2022 concludes.

Its latest published economic forecast stated that: “Interest rates will eventually head higher (although nowhere near what we saw in the 1980s). … The average rate for a 30-year mortgage is expected to rise to 3.3% by the end of 2021 and move up to 3.8% by the end of 2022.”

Having said that, it’s important for your clients to buy when they are ready. If they have a plan to start their search six months from now, and they’re comfortable waiting, that’s OK. Supply chain shortages, rising interest rates, and a modest slowdown in demand should prevent home prices from accelerating the way they did in 2021. They may even avoid some of the bidding war scenarios they’ve likely read about.

Rates still low through 2022

At one time, a rate below 4% was considered impossibly low. Yet, this is the level to which rates are predicted to rise in 2022.

That fact should be reassuring to homebuyers whose timeline is still a year out. Rates are rising, but not enough to make homebuying inaccessible.

According to Freddie Mac, the 30-year rate average at the time of this writing is around 3%, yet the average of 2022 forecasts is just 3.55%. That represents just a $76-per-month increase on a $250,000 mortgage.

Ultra-low mortgage rates should make homebuying a favorable proposition in 2022 and beyond.